The $78 Billion Digital Beauty Pageant

Welcome to China's beauty e-commerce ecosystem, where 450 million consumers spend more time deciding between serums than they do on major life decisions, and where your brand's survival depends on mastering platforms more complex than quantum physics. In 2025, selling beauty products in China isn't just commerce—it's digital theater, psychological warfare, and speed dating all rolled into one expensively packaged experience.

The Numbers That Will Make Your CFO Both Excited and Terrified

Before we dive into the digital beauty thunderdome, let's look at some numbers that explain why brands are willing to climb this Great Wall of E-Commerce:

- Total Market Value: $78 billion (roughly the GDP of Ethiopia, but with better skincare)

- Online Penetration: 72% (the remaining 28% probably just haven't figured out their phones yet)

- Mobile Shopping Rate: 85% (because apparently choosing foundation shades on a 6-inch screen makes perfect sense)

- Annual Beauty Product Purchases: 3.6 per consumer (or roughly 37 if they're a beauty influencer)

- International Brand Market Share: 42% (leaving 58% for local brands that appeared overnight with 500-page scientific whitepapers)

The 12 Platforms Where Beauty Brands Go to Thrive or Die Trying

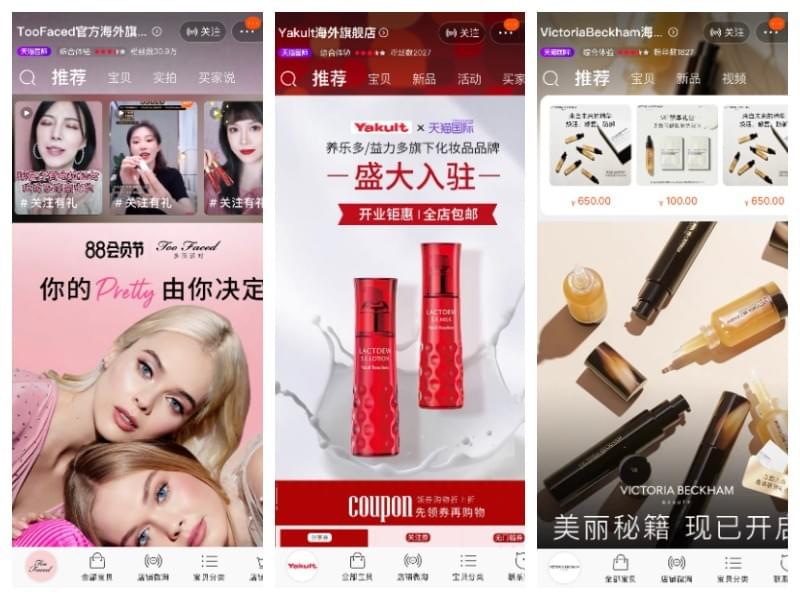

1. Tmall Beauty: Where Your Luxury Brand Goes to Feel Inadequate

- Monthly Active Users: 320 million (all with standards higher than Mount Everest)

- What It Actually Is: The digital equivalent of a high-end department store where consumers expect Rolls Royce treatment while comparing prices down to the penny. It's where international brands go to be simultaneously worshipped and ruthlessly critiqued.

- Key Audience: 25-40 year-old professionals who will spend three months' salary on a skincare routine but complain about the price of vegetables.

- Commission Rate: 3-5% (which somehow feels like 30-50% when you're calculating quarterly profits)

What Makes It Special:

- Luxury authentication stricter than most airport security

- AI recommendation system that knows your customers better than their spouses do

- Product verification so thorough it borders on scientific research

- Cross-border import channel that makes international logistics seem almost manageable

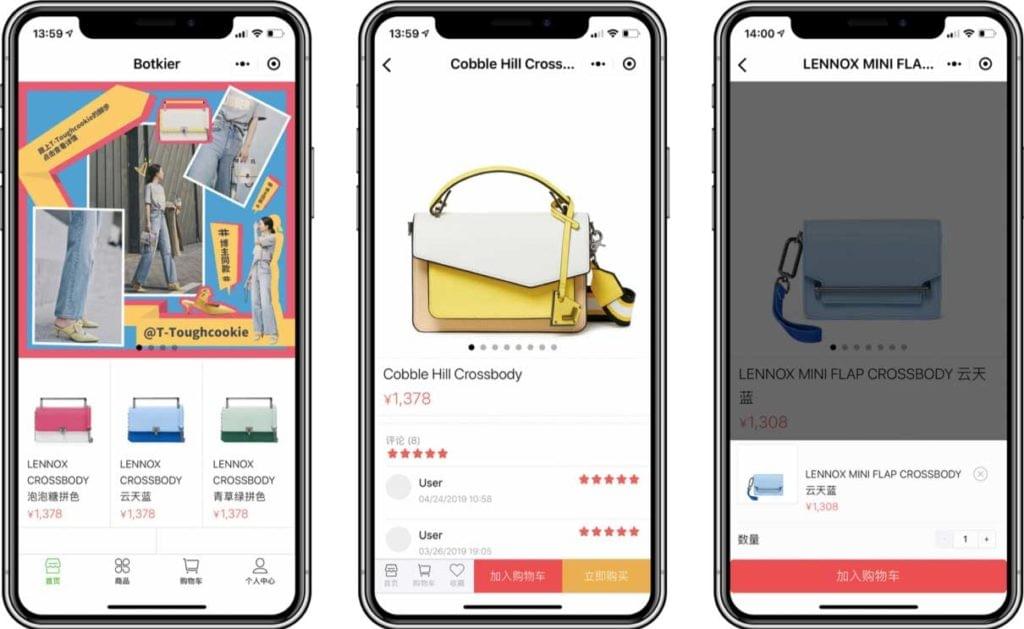

2. WeChat Mini Program Store: The Social Media Shopping Labyrinth

- Monthly Active Users: 250 million (all of whom are simultaneously chatting with 12 people while shopping)

- What It Actually Is: A digital mall hidden inside a messaging app, where your beauty brand sits somewhere between your customer's group chat about dinner plans and their grandmother's health updates.

- Key Audience: 18-35 year-olds who can simultaneously hold eight conversations, watch a livestream, and purchase three products without missing a beat.

- Commission Rate: 10-20% (the "convenience fee" for existing where consumers actually spend their digital lives)

Why Brands Can't Ignore It:

- Social media integration so seamless customers accidentally buy things

- Influencer marketing platform where 22-year-olds can make or break your quarterly revenue

- Real-time customer interaction allowing consumers to ask "is this good?" to 500 friends before buying

- Personalized shopping experiences that somehow know you've been thinking about trying a new lipstick shade

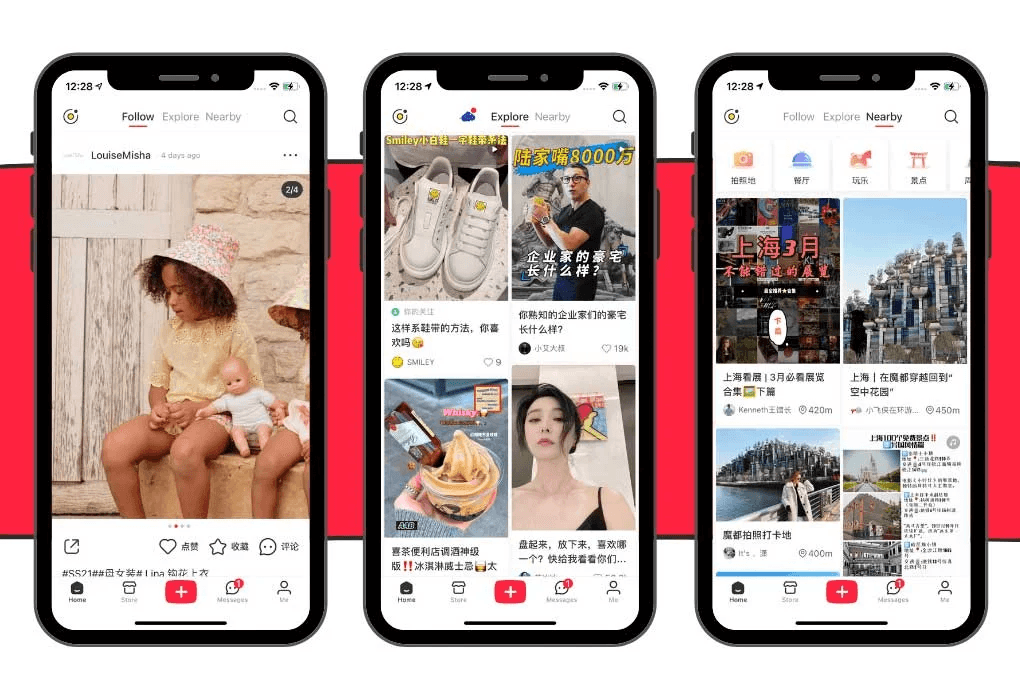

3. Xiaohongshu (RED): Where Beauty Products Are Judged by a Digital Jury of Millions

- Monthly Active Users: 200 million (all providing unsolicited opinions on your products)

- What It Actually Is: Part Instagram, part product review platform, part shopping mall, part social validation engine—it's where beauty products go to be dissected with the thoroughness of a forensic investigation.

- Key Audience: 20-35 year-old trend-conscious consumers who won't buy a lip balm without seeing 47 before-and-after photos from strangers.

- Commission Rate: 5-15% (the price of surviving trial by social media)

Why It's Both Amazing and Terrifying:

- Lifestyle content where your eye cream might appear next to someone's vacation photos and existential musings

- Influencer recommendations that can generate 10,000 sales or vicious product takedowns

- Community validation that turns ordinary customers into beauty detectives

- User reviews more detailed than most doctoral theses

4. JD Beauty: For Those Who Want Their Serum Delivered Before They Finish Reading About It

- Monthly Active Users: 180 million (all impatient and technologically demanding)

- What It Actually Is: The platform for beauty consumers who believe waiting more than 24 hours for delivery is a human rights violation and want to virtually try on 17 lipstick shades in 30 seconds.

- Key Audience: 25-45 year-old tech-savvy professionals who schedule their skincare routine on digital calendars with reminder notifications.

- Commission Rate: 2-4% (surprisingly reasonable for a platform that practically teleports products to consumers)

Technological Wizardry:

- AI product matching that sometimes knows what you want before you do

- AR try-on sophisticated enough to make you question physical reality

- Product testing that subjects formulas to more scrutiny than pharmaceutical trials

- Logistics system that makes Santa Claus look inefficient

5. Pinduoduo Beauty: Where Budget Beauty Goes to Party

- Monthly Active Users: 150 million (all looking for deals that seem physically impossible)

- What It Actually Is: A digital marketplace where the laws of retail economics appear to be suspended, and where consumers band together like bargain-hunting wolf packs to bring prices down to levels that make accountants weep.

- Key Audience: 18-30 year-old price-sensitive consumers who view full retail price the way vampires view garlic.

- Commission Rate: 10-25% (somehow still profitable despite selling products for what appears to be below cost)

How It Defies Financial Logic:

- Group purchasing that turns individual consumers into collective buying armies

- Viral marketing so effective it makes TikTok dances look unpopular

- Social sharing incentives that turn customers into commissioned salespeople

- Pricing so competitive it occasionally seems like a spreadsheet error

6. Douyin (TikTok) Shop: Where Your Products Better Look Good in 15 Seconds Or Else

- Monthly Active Users: 180 million (with attention spans shorter than this sentence)

- What It Actually Is: A platform where beauty products are sold through videos brief enough to fit between subway stops, creating a shopping experience with the pace of a music video and the impulse purchasing of a casino.

- Key Audience: 18-35 year-olds who make purchasing decisions faster than most people blink.

- Commission Rate: 5-15% (for selling products in less time than it takes to say "considered purchase decision")

Why It's Revolutionizing Impulse Buys:

- Livestream shopping that combines entertainment, peer pressure, and commerce

- Video-to-purchase pathways shorter than most attention spans

- Influencer integration that turns 19-year-old dance enthusiasts into beauty authorities

- Algorithmic discovery that knows what you want before your conscious mind does

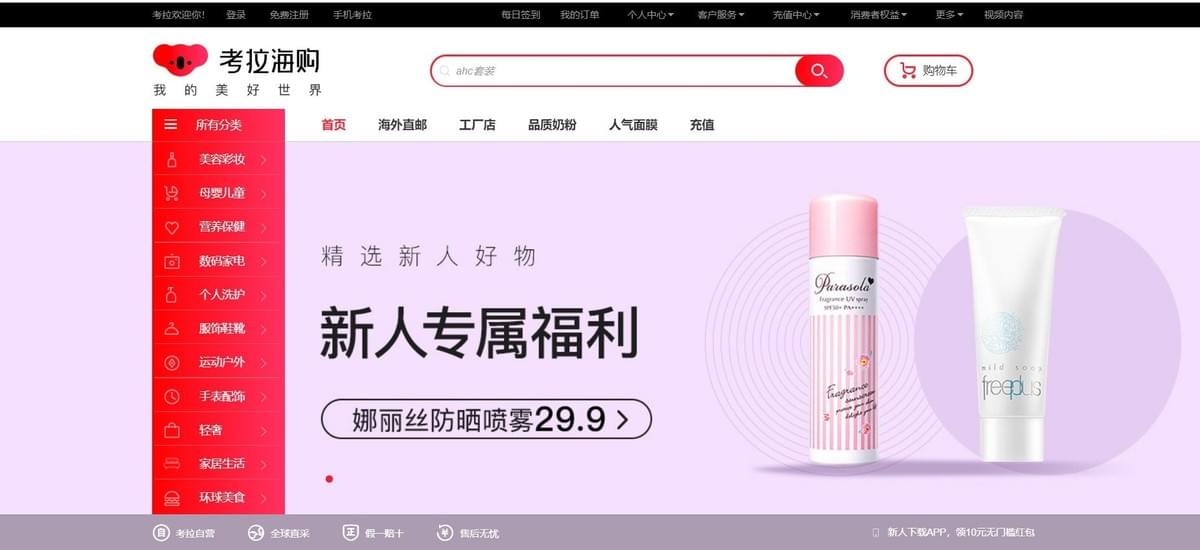

7. Kaola: For When You Want Foreign Products Without the Foreign Travel

- Monthly Active Users: 100 million (all seeking international products without passport requirements)

- What It Actually Is: A digital duty-free shop where Chinese consumers can buy foreign beauty products without the hassle of actually leaving China or worrying about authenticity.

- Key Audience: 25-45 year-old consumers who believe products work better if the instructions require Google Translate.

- Commission Rate: 3-8% (a small price to pay for simplified border-crossing)

International Appeal:

- Import processes simplified from "bureaucratic nightmare" to "mildly confusing"

- Authentic international brands (actual authenticity, not "fell off a truck" authenticity)

- Product testing thorough enough to make regulatory agencies look casual

- Taxation low enough to make accountants smile (a rare occurrence)

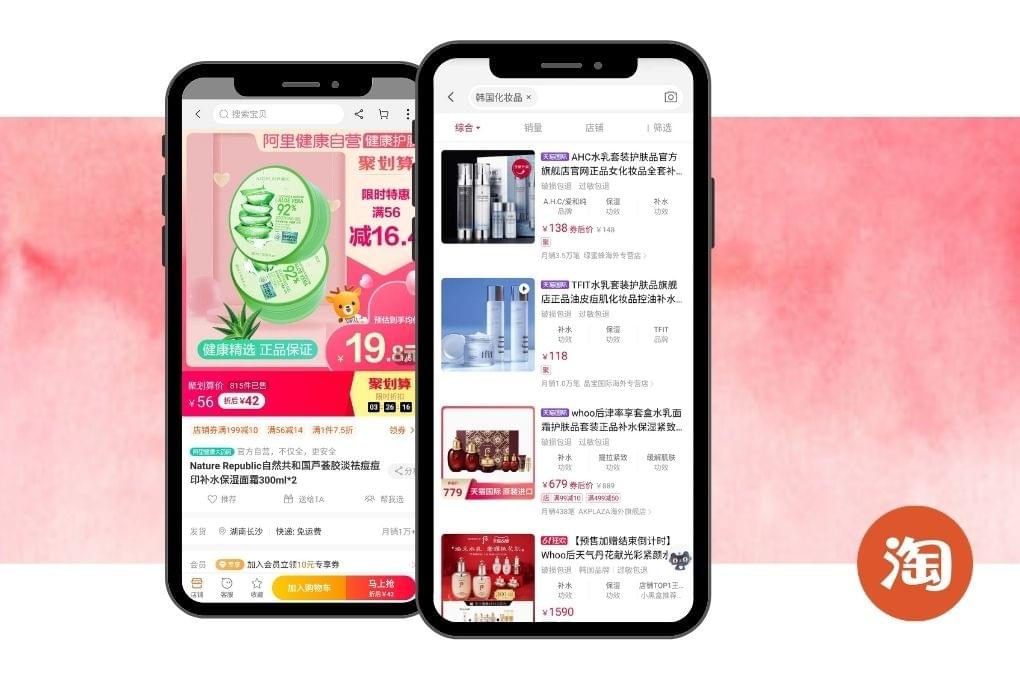

8. Taobao Beauty: The Wild West of Beauty Commerce

- Monthly Active Users: 300 million (navigating a platform with more beauty listings than there are stars in the galaxy)

- What It Actually Is: A beauty marketplace so vast and diverse it makes Amazon look like a corner store, where every beauty product ever conceived (and some that possibly shouldn't have been) is available at every conceivable price point.

- Key Audience: 20-40 year-olds across all income levels who enjoy product hunting as a competitive sport.

- Commission Rate: 1-5% (surprisingly low for what amounts to digital retail anarchy)

The Beautiful Chaos:

- Product variety so extensive it includes items you didn't know existed

- Pricing competition fierce enough to make economists question their understanding of margins

- Multiple sellers offering identical products in what amounts to a digital beauty thunderdome

- Consumer protection mechanisms that evolved from necessity after early Wild West days

9. Vipshop: Where Full-Price Is a Foreign Concept

- Monthly Active Users: 90 million (all addicted to the dopamine hit of flash sales)

- What It Actually Is: A digital outlet mall where beauty products go for one last chance at love, and where consumers have been conditioned to believe that 50% off is the new full price.

- Key Audience: 25-40 year-old value-seekers who have price comparison apps and calendar alerts for sales events.

- Commission Rate: 5-15% (which feels higher when everything's already discounted)

Discount Strategies:

- Limited-time offers that create more FOMO than exclusive club openings

- Clearance events that turn rational consumers into digital hoarders

- Dynamic pricing that changes faster than Shanghai weather

- Inventory turnover that makes fresh bread look shelf-stable

10. Suning Beauty: For Those Who Occasionally Remember the Physical World Exists

- Monthly Active Users: 80 million (who sometimes like to touch products before buying them)

- What It Actually Is: A rare platform acknowledging that physical retail still exists, offering a hybrid approach for consumers who want digital convenience but occasionally need human reassurance that green concealer actually works.

- Key Audience: 30-50 year-old established professionals who remember shopping before smartphones existed.

- Commission Rate: 3-7% (fair price for maintaining buildings with actual walls)

Real-World Connections:

- Physical stores that integrate with digital platforms more smoothly than most government services

- Product demonstration centers where you can actually smell that perfume before committing

- Consultation services with humans who don't glitch or need software updates

- Warranties comprehensive enough to make product failure almost desirable

11. Yihaodian: Where Beauty Meets Broccoli

- Monthly Active Users: 70 million (all trying to be healthier versions of themselves)

- What It Actually Is: A platform that understands the connection between inner and outer beauty, allowing consumers to add collagen supplements to their cart alongside their foundation and perhaps some organic kale.

- Key Audience: 25-45 year-old health-conscious consumers who have more wellness apps than social media apps.

- Commission Rate: 4-10% (the wellness premium)

Holistic Selling Points:

- Wellness integration that places your night cream next to vitamin D supplements

- Nutritional products that promise to make your skincare work better (results may vary)

- Scientific verification slightly more rigorous than "my cousin tried it and loved it"

- Health recommendations personalized enough to make you wonder if they've installed cameras in your bathroom

12. Alibaba's Intime: For Beauty Shoppers with More Money Than Time

- Monthly Active Users: 60 million (the digital elite with platinum credit cards)

- What It Actually Is: A luxury beauty platform where price tags have more zeros than binary code and where personal shopping assistants remember your preferences better than your spouse.

- Key Audience: 30-50 year-old luxury consumers who consider drugstore brands a human rights violation.

- Commission Rate: 2-5% (seemingly low until you calculate it on luxury price points)

The Ultra-Premium Experience:

- Shopping consultants who text you more regularly than your best friends

- Exclusive collections not available to ordinary mortals

- Customer service representatives who pretend to remember your birthday

- Digital experiences immersive enough to make virtual reality seem obsolete

Strategic Insights (Or How Not To Fail Spectacularly)

The Five Commandments of Chinese Beauty E-Commerce

- Platform-Specific Marketing: What works on Tmall might flop on Douyin faster than a failed soufflé

- Cultural Content Adaptation: That campaign that won awards in Paris might cause a PR crisis in Shanghai

- Influencer Collaboration: In China, a 22-year-old with good lighting can make or break your brand overnight

- AI-Powered Personalization: If you're not using AI, your competitors are using it against you

- Continuous Innovation: Today's revolutionary feature is tomorrow's basic expectation

Conclusion: Beauty Is Pain, Beauty E-Commerce Is Beautiful Pain

China's beauty e-commerce isn't just evolving—it's mutating at a pace that makes digital Darwinism look sluggish. These 12 platforms represent more than just sales channels; they're complex ecosystems where technology, culture, consumer psychology, and occasionally rational decision-making converge.

For beauty brands, the question isn't whether to enter these platforms but how to navigate them without getting digitally trampled in the process. The rewards are immense, but so are the challenges—much like trying a new skincare routine, the results could be transformative or disastrous.