The Tale of Two Consumer Universes: Parallel Dimensions in Shopping

Welcome to 2025, where the Chinese and Western consumer markets have evolved about as similarly as dolphins and oak trees. Both are technically life forms on the same planet, but that's where the similarities end. With China's $7.5 trillion consumer economy and 1.4 billion increasingly sophisticated shoppers who think your Western marketing playbook belongs in a museum, understanding these differences isn't just important—it's the difference between spectacular success and becoming a business school case study in spectacular failure.

Why Your MBA Doesn't Work in China

Before we dive into the specifics of why your carefully crafted Western marketing strategy will implode spectacularly in China, let's acknowledge some fundamental truths:

- Digital Ecosystem: China built an entirely different internet while you weren't looking

- Consumer Psychology: Chinese consumers think your brand story is cute but unconvincing

- Technology Adoption: While the West debates the ethics of new tech, China has already implemented it, improved it, and moved on to the next thing

- Purchase Motivations: That emotional appeal that tested brilliantly in focus groups? It translates about as well as poetry through Google Translate

The 5 Differences That Will Keep Marketing Directors Awake at Night

1. Social Commerce: Or Why Chinese Consumers Buy While Westerners Are Still Thinking About It

The Western Shopping Expedition:

Western consumers approach online shopping like a Victorian explorer—deliberately, cautiously, with multiple maps and a separate compass. The journey from discovery to purchase involves:

- Separate platforms for browsing and buying (like reading a restaurant review on Yelp, then driving across town to eat there)

- A linear purchase journey so predictable you could write a screenplay about it

- Social media for inspiration, separate websites for actual purchases

- Average conversion rate of 2-3% (meaning 97-98% of shoppers are just digital window shoppers)

The Chinese Shopping Teleportation:

Chinese consumers don't so much "journey" to a purchase as teleport instantly from interest to ownership, enabled by:

- Seamless social shopping where the line between entertainment and commerce doesn't exist

- Purchase pathways so integrated you can buy something without feeling like you made a decision to shop

- Social platforms that function as shopping malls, entertainment venues, and payment processors simultaneously

- Staggering 15-20% conversion rates (meaning Chinese consumers actually buy things instead of just looking at them)

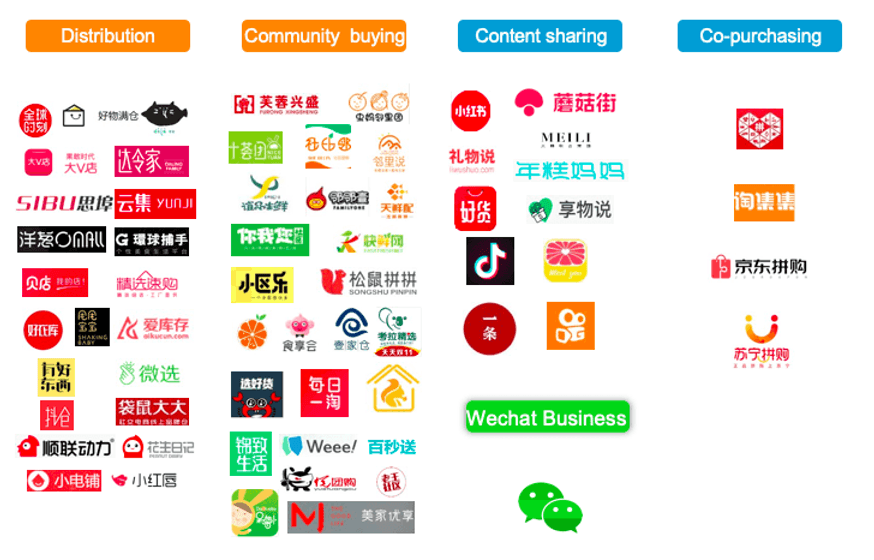

The Apps Making Western Marketers Question Their Career Choices:

- Xiaohongshu (小红书): Where product recommendations feel like advice from friends instead of advertisements

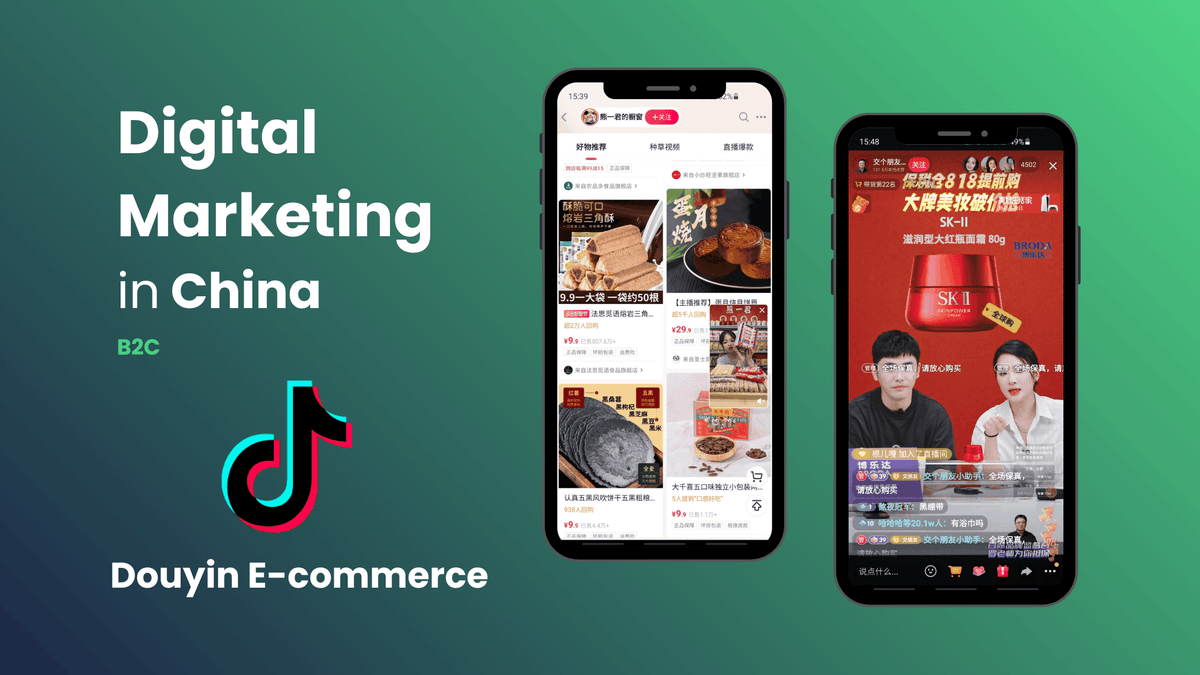

- Douyin (抖音): Where you can watch a 15-second dance video and somehow end up buying a refrigerator

- WeChat Mini Programs: The digital equivalent of entering a store that's inside another store that's inside an app

- Pinduoduo (拼多多): Where group buying turns shopping into a team sport with leaderboards and everything

2. Mobile Payment: When Your Wallet is an Endangered Species

Western Payment Archaeology:

Western consumers in 2025 still approach payments like amateur archaeologists, digging through:

- Physical wallets containing plastic cards and (gasp) actual paper money

- Multiple payment methods requiring different authentication processes

- A mobile wallet penetration rate of 30-40% (used primarily by people under 35 who don't remember Blockbuster)

- Credit cards that are still swiped or inserted like it's 2010

Chinese Payment Evolution:

Chinese consumers have evolved beyond physical payment methods like humans evolved beyond tails:

- A mobile-first payment culture where pulling out a wallet in public marks you as either a tourist or time traveler

- QR codes so ubiquitous they appear in dreams

- A cashless society so complete that children think paper money is a quaint historical artifact

- Mobile payment rate of 85-90% (the remaining 10-15% are primarily visitors struggling to download payment apps)

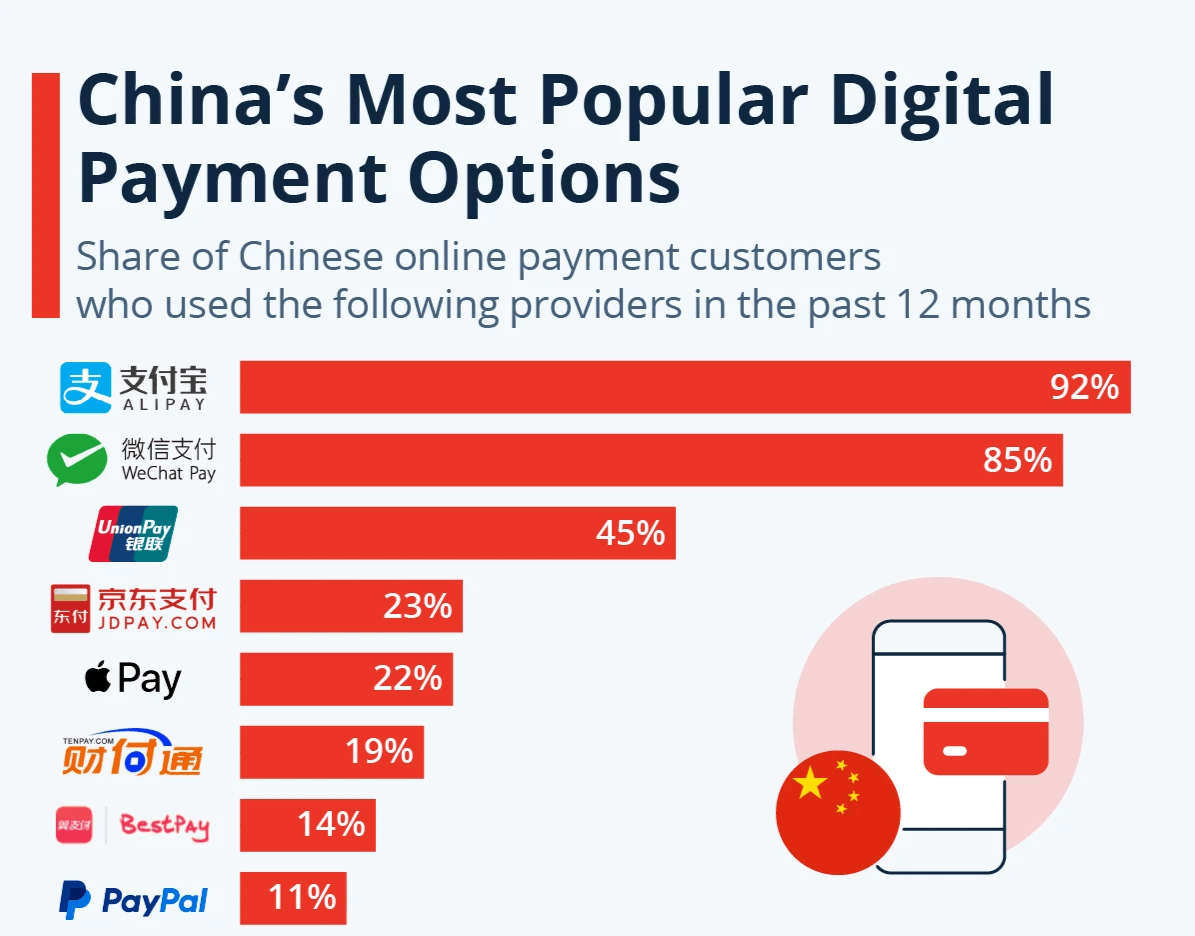

The Payment Platforms That Make Western Banks Look Like Vintage Collectibles:

- Alipay (支付宝): The payment system that knows your spending habits better than your spouse

- WeChat Pay (微信支付): Proving that messaging apps can become financial institutions if they try hard enough

- UnionPay: For when you nostalgically want to use something resembling a card

3. Brand Trust: Where Your Corporate Messaging Goes to Die

Western Trust Construction:

Western consumers build trust in brands like they're evaluating potential romantic partners—slowly, cautiously, with healthy skepticism:

- Individual reviews from strangers they'll never meet

- Professional critics whose job is to have opinions about things

- Brand-controlled narratives delivered through advertising

- Trust development that's slow and often conditional

Chinese Trust Ecosystem:

Chinese consumers develop trust through a complex social web that makes Western review systems look primitive:

- Community validation that turns purchasing decisions into group activities

- KOL (Key Opinion Leader) recommendations that carry the weight of religious proclamations

- User-generated content so voluminous it would take several lifetimes to consume

- Trust development that's rapid but brittle if betrayed

The Platforms Where Brand Reputations Are Made or Destroyed:

- Xiaohongshu Product Reviews: Where consumers write novel-length assessments of lip balm

- Weibo Brand Discussions: Where trending hashtags can make your quarterly earnings or destroy them

- Douyin Authentic Content: Where being genuine for 15 seconds carries more weight than a million-dollar ad campaign

- WeChat Community Groups: Where consumers discuss your product with the intensity of sports commentators analyzing a championship game

4. Digital Content: Why Your Three-Minute Brand Video is Two Minutes and Forty-Five Seconds Too Long

Western Content Consumption:

Western digital content is consumed like a formal dinner—structured, somewhat predictable, with distinct courses:

- Long-form content that assumes consumers have the attention span of 19th century novel readers

- Detailed explanations that methodically build cases for products

- Text and image dominance because video production is "expensive" and "time-consuming"

- Average engagement of 3-5 minutes (while simultaneously checking email)

Chinese Content Velocity:

Chinese digital content is consumed like a high-speed conveyor belt sushi restaurant during a lunch rush:

- Short-form video supremacy that makes TikTok look like epic cinema

- Visual storytelling so efficient it can convey an entire product ecosystem in seconds

- Interactive, gamified content that makes passive consumption feel like doing homework

- Engagement of 8-12 minutes achieved through rapid consumption of multiple content pieces

The Platforms Redefining Human Attention Spans:

- Douyin: Where 15 seconds is considered plenty of time to tell a complex brand story

- Bilibili: Where content without interactive elements feels broken

- WeChat Video Channels: Where longer content is tolerated if it's entertaining enough

- Kuaishou: Where authenticity trumps production quality every time

5. Consumer Segmentation: When "Millennials" Becomes an Embarrassingly Broad Category

Western Segmentation Finger Painting:

Western marketers approach consumer segmentation with all the precision of a kindergartner's art project:

- Broad demographic categories (Millennials, Gen Z, Boomers)

- Limited personalization based on obvious data points

- Generic marketing approaches that aim for the middle of very large targets

- Personalization that barely scratches the surface of individual preferences

Chinese Segmentation Microsurgery:

Chinese marketing technology approaches segmentation with the precision of quantum physics:

- Micro-segments so specific they could identify consumers based on their walking patterns

- AI recommendations that predict desires consumers haven't consciously formed yet

- Contextual marketing that changes based on time of day, weather, and recent social interactions

- Personalization so granular it occasionally feels like gentle stalking

The Technologies Making Western Data Analytics Look Like Abacuses:

- Tencent AI Recommendations: Algorithms so advanced they're probably sentient

- Alibaba Cloud Intelligence: Data processing that makes Western "big data" look like a spreadsheet

- ByteDance Personalization Engines: Content matching that borders on mind reading

So You Want to Enter the Chinese Market? Strategic Implications for the Brave

Key Takeaways for Brands with High Pain Tolerance:

- Localization is Not Optional: Translation is to localization what a tricycle is to a Tesla

- Mobile-First is the Only Approach: If your strategy includes the phrase "desktop experience," you've already lost

- Community Matters More Than Individual: Chinese consumers make decisions collectively, not individually

- Authenticity Trumps Production Value: Perfect production with empty content fools no one

- Technology is the Ultimate Differentiator: If your tech stack isn't cutting edge, you're bringing chopsticks to a laser fight

What's Coming Next: Consumer Trends That Will Further Complicate Your Life in 2025

Emerging Trends That Will Make Today's Challenges Look Simple:

- Sustainability Consciousness: But with Chinese characteristics that Western brands frequently misinterpret

- Digital-Physical Retail Convergence: Creating shopping experiences that make the metaverse look one-dimensional

- Wellness and Holistic Lifestyle: Health trends that blend traditional Chinese medicine with cutting-edge technology

- Hyper-Personalized Experiences: Making today's personalization look generic and clumsy

Conclusion: Your Five-Year Plan Probably Needs a Rewrite

Success in the Chinese consumer market doesn't just require translation—it demands a fundamental reimagining of every marketing assumption you hold dear. It requires technological agility, cultural fluency, and the humility to acknowledge that Western marketing success guarantees absolutely nothing in China.

The brands that thrive will be those willing to start from scratch, learning the Chinese consumer landscape as if they've never marketed anything before. Because in many ways, they haven't—at least not to this parallel universe of consumer behavior that happens to share the same planet as Western markets.

The good news? The Chinese consumer economy is $7.5 trillion and growing. The bad news? Everyone else has read this guide too.